In Part II, I narrowed down a list of thousands of liens to roughly 30 I wanted to bid on. Now came the hard part: how much should I bid for these liens?

I built a Monte Carlo simulator that took in several parameters:

- Number of liens

- Average lien price

- Average premium percentage

- Number of iterations to simulate

Looking at the chart from Part I, there is a roughly 15% percent chance that the lien is never redeemed by the property owner. Yet, Colorado claims transfer of deed happens in less than one percent of all purchases. How can that be? I believe this is because most elect to not to go through the transfer of deed, because the lien they end up with is a dead end property as described in Part II. Since I narrowly targeted properties, this was not a concern for me. I thus marked liens that went past 40+ months as a “transfer of deed” with a conservative $15,000 return.

Still, this didn’t sit well with me even though El Paso’s statistics clearly indicated a nontrivial number of liens remained unredeemed past 40+ months. So, in the simulator, I separated the “non-house” iterations from those that “won” a house to give me a better view of what would happen if all of my liens would be redeemed.

So my output looked like this for 7 liens, $1200 each, 8% premium, 10000 iterations:

Over 10000 iterations:

Average outlay: $18693.12

Subtaxed the next year: 3.96 Pct: 0.57%

Average profit: $17459.30; 93.40%

Number of losing iterations: 36; 0.36%

Number of iterations without houses: 3822; 38.22%

Average outlay (no house only): $17640.92

Average profit (no house only): $1331.01; 7.55%

Number of losing iterations (no house only): 36; 0.94%

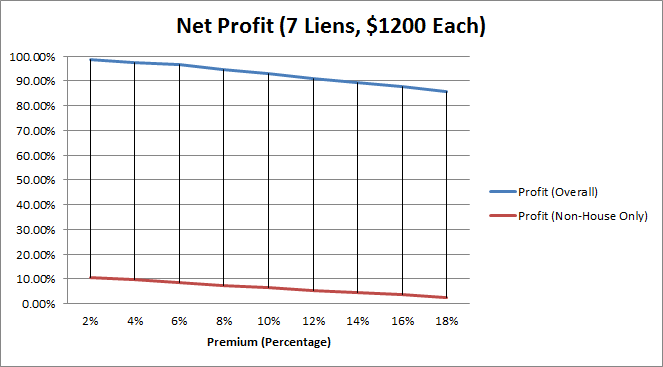

Here’s an Excel graph of estimated profits over increasing premiums using the same inputs, divided between house and non-house:

The net profit I would make on tax liens, with and without the assumption I’d get a transfer of deed.

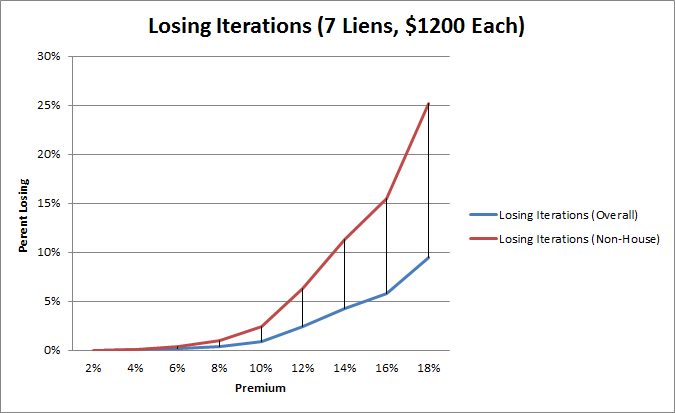

Another view, the percentage of time I would lose out:

Obviously, the premium played a big factor into the “riskiness” of the tax liens and the net profit I’d make on them. We agreed to bid up to 10% on them, as that still had a low chance that we’d lose out plus they would yield a generous 6.57% on average even if we wound up with no transfer of deed.

Now it was time to bid! Part IV covers what happened at the auction and thereafter. You may download my crappy Perl code if you wish, here: tax_lien_monte_cristo

Leave a Reply